How to Use a Borrowing Power Calculator to Determine Borrowing Capacity

If you’re wondering, “How much can I borrow?” then you should start with a borrowing power calculator. Why? Because a loan calculator is one of the easiest ways to find out how much you can afford to borrow. And once you know how much you can borrow, you’re ready to start house hunting!

But first things first. What exactly is a borrowing capacity calculator? Why should you use one? And how can you make sure you’re using it correctly?

What is a Borrowing Power Calculator?

If you’re searching for a borrowing power calculator online then you might come across a bunch of calculator references: mortgage calculator, loan calculator or a borrowing capacity calculator. Don’t let these confuse you – they all mean the same thing. They’re a calculator that will help you figure out how much a lender might be willing to loan you so you can buy a house.

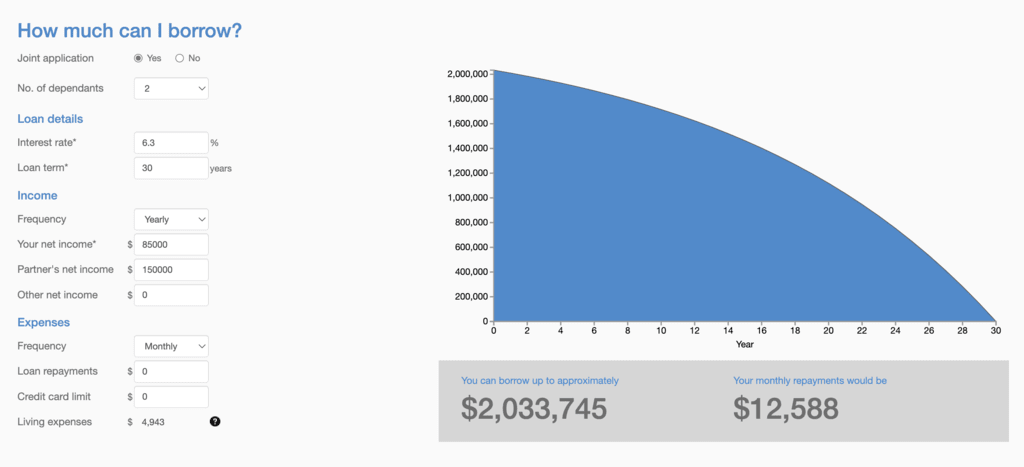

How do they work? A borrowing capacity calculator will prompt you to put in some basic information about your income, your expenses and whether or not you have any dependants. These are all things that affect your borrowing capacity. The calculator will then use this information to work out how much you can borrow.

Why Use a Mortgage Calculator?

A mortgage calculator isn’t the same as a loan approval. It can’t give you a guaranteed amount that you can borrow. So, why use them? Because they’re a great tool to help you get started. The benefits of using an online calculator include:

- You can use it when it best suits you (before work, after work, the middle of the night, etc.)

- You’ll be arming yourself with useful information before meeting with a lender.

- It will help you understand how much you could borrow under different circumstances

How to Use a Borrowing Power Calculator

Here’s a quick rundown of how to use an online calculator, like the one at North Brisbane Home Loans:

- Start with Basics: Decide if it’s just you or a joint application.

- Family Matters: Enter how many dependents you have.

- Play with Numbers: Adjust the loan details to see different options.

- Income Stuff: Add up your net income, plus any extra income you’ve got coming in.

- Expense Check: List your expenses and how often you pay them.

Once all your details are in the calculator, you’ll see an approximate amount you can borrow and what your monthly repayments might be on a loan that size.

Limitations of Online Calculators

No matter how detailed they might be, all online borrowing calculators have limitations. They’re a great starting point to understand your estimated borrowing power, but, at the end of the day, they are still just estimates. Generally, an online loan calculator will not include your credit score, detailed information about your home expenses or your employment stability (all things that a lender will consider before approving your application). However, a calculator will give you a ballpark figure so you can better understand the possibilities…before you speak to a lender.

Beyond the Mortgage Calculator: What Should You Do Next?

Once you have your online estimate, your next step is to speak to a mortgage broker – an expert in personalised, comprehensive financial assessments – so you can access the right home loan from the right lender for your circumstances.

A mortgage broker takes the hassle out of financial assessments by helping you every step of the way. They can assist you even when you are self-employed and have complex needs when it comes to reporting your income and expenses (the things an online calculator can’t help with!).

Talk to an Expert About How Much You Can Borrow

At North Brisbane Home Loans, we handle the entire loan application process, from assessing your financials and identifying your available loan options to submitting the paperwork to your chosen lender and handling the final settlement.

Try out our online borrowing power calculator to get an idea of your borrowing potential, then book a FREE appointment with one of our home loan experts to start your stress-free home loan application.

Patrick Cranshaw, a Certified Mortgage Professional for over 21 years, founded North Brisbane Home Loans in 2002. His career began with ANZ Bank in New Zealand, where he progressed over 16 years to a Business Banking role in Virginia. After moving to Brisbane in 2000, Patrick led the QLD market for a home loan agency, helped set up the REMAX Real Estate Finance division, and practiced as a broker.