Help to Buy Scheme: Everything You Need to Know About the Second Home Buyers Grant QLD

How long will it take you to save a house deposit? With the upcoming Help To Buy Scheme, it might not be as long as you think.

According to the latest figures from PropTrack, it takes an average-income household in Queensland around 5.4 years to save a 20% deposit for a mortgage. And that’s only achievable if you’re saving 20% of your income that entire time. Fortunately, there could soon be a viable alternative.

What is the Help To Buy Scheme Australia?

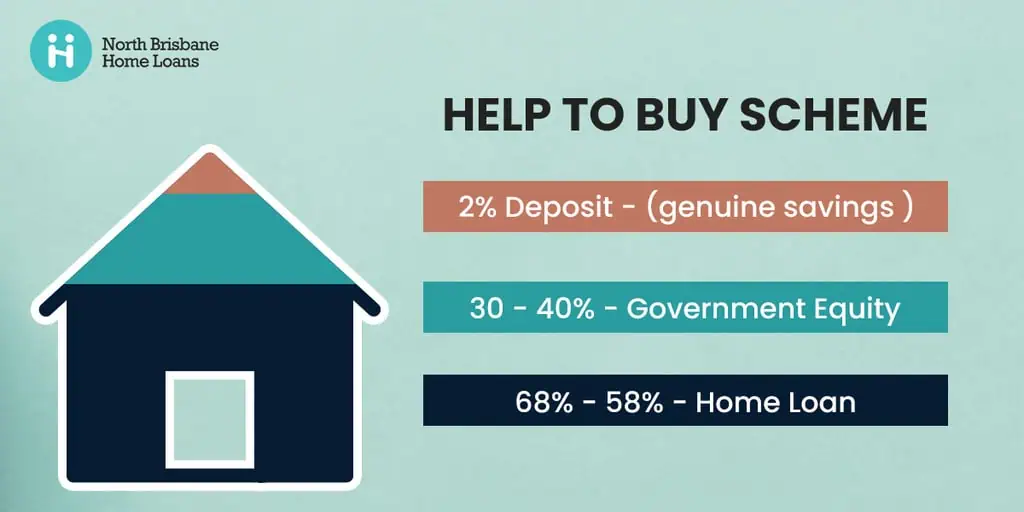

The Help To Buy Scheme Australia was announced as a shared equity plan to help applicants purchase a house in “co-ownership” with the government.

This new scheme will cover 30% of the purchase price of an existing home and 40% for a newly built home. For the remaining 60-70%, you can apply for a mortgage with a deposit of just 2%, and you won’t have to pay any Lenders Mortgage Insurance (LMI).

How Will This Scheme Work?

Due to start in 2024 (although no firm date has been announced yet), the scheme is scheduled to run for 4 years, with 10,000 places available annually. As a successful applicant, you’d supply a 2% deposit, while the government effectively loans you 30-40% of the purchase price. While living in the property you won’t have to pay any rent for the percentage owned by the government.

If you decide to sell the property in the future, the loan from the government will be repaid from the proceeds of the sale. The amount to be repaid will be based on the percentage owned, not the original sale price.

Who Will Be Eligible for the Second Home Buyers Grant QLD?

There are certain eligibility criteria you’ll need to meet if you want to apply for the initiative. This includes:

- You must be 18 or older, and an Australian citizen.

- Your annual income can’t exceed $90,000 for singles or $120,000 for couples.

- You can’t currently own property in Australia or overseas.

- You don’t have to be a first home buyer (which is why it’s also referred to as the ‘Second Home Buyers Grant QLD’).

- You’ll have to live in the property after the sale is finalised.

- You’ll supply a 2% deposit and cover up-front sale costs such as stamp duty, legal fees, etc.

- You’ll need to cover ongoing costs, including rates, maintenance and utility bills.

There will also be a cap on the property purchase price, which will vary by state and region. In Queensland, the cap will be $700,000 for cities (including regional city centres) and $550,000 for everywhere else.

What are the Benefits of Using the Proposed Help To Buy Initiative?

This proposed initiative offers significant benefits. You could buy your own home faster, with a smaller deposit and with more affordable repayments.

For example, imagine you want to buy a new house in Brisbane for $650,000. Without the Help To Buy Scheme QLD, you’d have to save up $130,000 to avoid paying LMI. This could take 5+ years. You’d then have to make repayments on a $520,000 home loan (with a 30-year term and a 7% interest rate, that’s about $3,460 per month).

Instead, you decide to apply for the Help to Buy initiative. For the same property, you’ll only have to save up $13,000 for your 2% deposit (with no LMI). Even better, the scheme would cover 40% of the purchase price ($260,000). This would leave you with a mortgage of just $377,000, bringing your monthly repayments down to $2,508.

Talk to North Brisbane Home Loans About Getting Help in Buying Your Home

Does the Help to Buy Scheme sound like it could be the ideal solution? While no firm date has been provided yet, once submissions open, you’ll need to be ready to act fast!

Fortunately, the team at North Brisbane Home Loans are here to help. We can talk you through the various pros and cons of the scheme, answer your questions and calculate your borrowing capacity… We can even help you apply for the scheme once it’s officially launched.

Don’t miss out on this golden opportunity! Book an appointment with the experienced brokers at North Brisbane Home Loans today.